It’s hard to believe we’ve already completed a quarter of the Earth’s trip around the sun in 2025. Although, thinking of the torrent of news that has hit us all in the past 90 days and the resulting maximum number of brain cycles to try to take it all in… maybe it does feel like it’s been that long.

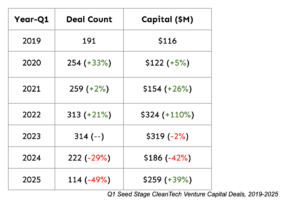

It’s tough to remember a more disruptive start to the year, in terms of policy changes, economic uncertainty and the potential for geopolitical realignments, but as venture capitalists, it’s not only our job to predict the future, but also think in time periods of much longer than 4 years. In fact, here at Evergreen with our trademarked 501VC model, we think in timeframes longer than 10 years, as we believe given this longer time cycle innovations of all kinds will have the opportunity to hit their inflection point and create significant value and impact. So while Q1 of 2025 was unexpected in many ways, the clean tech venture capital corner of the economy was… not that bad? While there was a year-over-year contraction in terms of deal flow from 2024, capital deployed actually went up by 11%. This YoY increase in capital was in large part due to the continuation of high value later stage rounds, such as KoBold’s $537m Series C and Helion’s $425m Series F. This is promising, as it indicates that there is still investor appetite to invest in late stage cleantech companies that might still be a ways away from commercial revenue and to ultimately become cash flow positive. As can be seen in the chart below, capital deployment is still multiples over where the industry was in 2019, and has also demonstrated continued growth after omitting the ZIRP years of 2021 and 2022.

The downside to this chart is that deal flow continues to be on a pretty notable negative trajectory. The number of cleantech deals has collapsed from roughly 500 in Q1-2023, to 400 in Q1-2024 and now 300 in Q1-2025. At this pace, there will be nothing left to invest in in 2028!

All kidding aside, the contraction in overall deal count is something that is also seen in the larger venture capital sector, so is not something unique to the cleantech economy. The overall sector saw a 30% contraction in YoY Q1 deal count, but actual capital deployed was up an astonishing 124%. This large number was buoyed by the record-breaking $40bn deal by OpenAI, but even when omitting that outlier, capital deployed was still up a healthy 26%.

Interestingly nearly all of the deal flow contraction for cleantech deals was concentrated in the Pre-Seed and Seed stage space. Seed (and prior) rounds decreased by 108, or 50% (!), year-over-year. As the chart below shows, the amount of capital deployed in this area of the startup world is still pretty healthy by historical standards compared to previous Q1s of prior years.

|

|

|

What is quite interesting is that the deal count in this area is the lowest in over 10 years. That level of contraction is not something we have seen in the past few years of running this analysis, and is contrary to the point of view that entrepreneurs will always be starting companies. However, given the level of uncertainty in the world, especially when public companies with armies of analysts can’t even settle on a single level of guidance in their quarterly reports, it’s no surprise that entrepreneurs may find the waters around them to be a class 5 rapid and to instead delay for calmer waters. We will keep in mind that this is only a single data point and almost certainly is due to a confluence of factors in 2024 and not a result of any impact from the current administration, as deals typically do not close that quickly.

The flip side is that exits of all industries, but especially in cleantech, have nearly been non-existent. This chart shows that even from the depressed levels of 2023 and 2024, 2025 is off to a very poor start, indicating we may be in for another year of lackluster exit opportunities.

From our perspective, it’s tough to see when the challenges associated with going public in this environment will be alleviated, but it is comforting to see that capital deployment into the cleantech sector has not slowed down. We, as I’m sure everyone reading this, will continue to digest this data as the year progresses and keep our heads on swivels as the environment around us continues to see lots and lots of change.

***

As always, all data referenced here is queried from Pitchbook. Please let us know if there is any additional analysis you would like to see in future posts on this subject.

***