Halfway through 2025, and there’s been no shortage of headlines and policy shifts that have put entrepreneurs, employees, investors, and nearly everyone else in a dizzying state of uncertainty. Along with these directional shifts, we have also seen a clear shift in the climate tech venture capital space from previous years. But it might not be in the way that you would think…

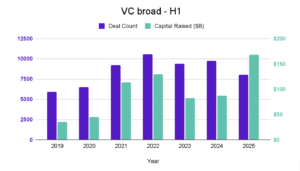

It’s not that there is less money being invested in the climate tech venture capital space. Far from it, actually. The number of dollars being invested in climate tech deals increased 35% year-over-year to $9.4bn. This is a healthy increase for any year, and that is especially the case given the headwinds impacting the climate tech sector in 2025. And while venture capital as a whole saw a whopping 93% annual increase in capital entering the sector so far in 2025 compared to 2024, it is important to note that the top 1% of deals so far this year accounted for 42% of the total capital deployed. It turns out that AI not only takes a lot of energy, but also a lot of money. When removing these outliers from the data, the growth in climate tech venture capital far exceeded the growth seen in the rest of the venture capital sector. This is good, right? Climate tech deals are still being done even in the face of policies that are looking to actively undermine the sector.

|

|

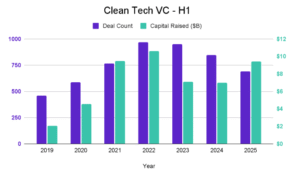

| VC deal count & capital raised, in first two quarters, since 2019 | Clean Tech VC deal count & capital raised, in first two quarters, since 2019 |

That is true… but looking deeper in the data reveals some worrying signs. For the past three years, the general trend in climate tech venture capital has been that of declining deal count. While this could be concerning, it’s important to note that three years ago was a peak in not only climate tech, but also the venture space in general. Interest rates that hovered barely above 0% and the passage of the CHIPs and Inflation Reduction Acts by Congress set out whole new incentive programs and initiatives that really jumpstarted the sector and led to a record-setting number of deals being closed.

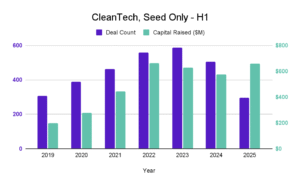

2025 however, shows quite a different story. We’ve seen interest rates remain stubbornly high, though they may start coming down as more signs point to an economy where the Federal Reserve will likely weigh the employment side of their dual mandate more than inflation. There are also all types of uncertainty in the economy, with varying tariff rates and global trade flows being shaken more than they have in generations. All this may have made entrepreneurs hesitate in starting a new company, specifically in the climate tech sector. And the data supports this, as there has been a significant reduction in the number of companies that are closing deals in the climate tech sector in the first half of 2025. Seed stage deals saw an alarming reduction of 42% in year-over-year deal count from 2024, reducing from 506 to 295. This is represented by the marked reduction in the purple bars in the below chart.

|

| Climate Tech Seed deal count & capital raised, in first two quarters, since 2019 |

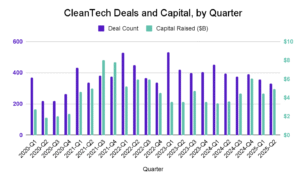

As the chart below shows, this reduction is a marked increase in the general direction we have seen in the number of deals closing in the climate tech sector.

|

| Quarterly Climate Tech VC and Deal Count, since 2020 |

It might be easy to chalk this contraction to be specific to the climate tech sector. It is in the administration’s crosshairs perhaps more than any other industry. However, this contraction is not unique to the climate tech sector, as the venture capital industry overall also saw a similar 38% decrease in Seed stage deals closed to-date. This suggests that larger economic factors that extend beyond climate tech are impacting the decision making for entrepreneurs to make the leap to start a new company.

It’s too early to say this is a new normal, or that this trend will continue to show a slowdown in the number of venture capital deals being closed. However, the Seed stage deals of today are the Series A deals of tomorrow. So if this continues for a few more periods, then that will be a troubling sign of what may be to come.

We’d love to hear any thoughts that our community might have as to why such a dramatic reduction of Seed stage deals is occurring. This will be something we’ll continue to track and report in the upcoming periods as well.

***

As always, all data referenced here is queried from Pitchbook. Please let us know if there is any additional analysis you would like to see in future posts on this subject.

***