2025 was a year that can be described with no shortage of manic words. Uncertain? Absolutely. Surprising? You can say that again. And within the specific intersection of innovation and climate technology, these adjectives were probably even more pronounced.

We saw the climate tech venture capital space being pulled, particularly violently, in both positive and negative directions all throughout 2025. The negative forces were driven by the slew of Executive Orders from the White House and rollback of clean energy-friendly Inflation Reduction Act policies as a part of the One Big Beautiful Bill that passed in 2025. The positive forces were, and will continue to be, propelled by the largest electricity demand growth seen in at least a generation. The latter is driven by a major proliferation of large AI-driven data centers (obviously), aging infrastructure in the power grid and increasing electrification in the everyday lives of consumers. From our perspective at Evergreen, the staying power and the magnitude of the market pull pressed upon stakeholders all across the power sector greatly exceeds any drag created by an unfriendly regulatory environment. So this is a great time to bring innovative solutions to the market that will aid in this period of energy transition and expansion. Within this context, it’s particularly important to look back on 2025 and see how climate tech venture capital funding in the US was impacted by all these competing pressures, if at all.

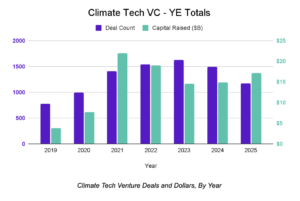

On the surface, 2025 was a year in climate tech venture capital that shared similar macro trends to the overall venture capital space. These commonalities were characterized by a decreasing deal count accompanied with increasing capital deployment. This theme was mentioned in earlier blog posts throughout 2025, so it shouldn’t be that big of a surprise. However, there are some particular nuances within this data that would warrant further investigation.

As can be seen in the chart above, deal count (represented by the purple bars), has decreased in multiple consecutive years and has overall seen a 28% decrease since the high water mark in 2023. That record high count a few years ago was no doubt driven in part by the passage of the IRA a year earlier, spurring record levels of activity at earlier funding stages in order to capitalize on new market opportunities. Interestingly, this is nearly the exact same contraction percentage that has occurred in the overall venture capital space since its high water mark earlier this decade, suggesting some external factors beyond just an unfriendly regulatory environment have something to do with this.

On the other hand, capital deployment in the venture capital space tells quite a different story. The dollars funneled into climate tech companies did increase 16% YoY to $17.2bn. However, this is still 22% below the peak for the industry, which occurred in 2021. The venture capital sector more broadly is seemingly flush with cash, deploying a record $259bn in 2025. Not only was this a massive 52% YoY increase from 2024 levels, but the amount of dollars being deployed has grown 150% over just the past two years. Ludicrous speed indeed.

The dominant ingredient behind this explosion of capital are the capital-intensive frontier AI companies that have cropped up over the past few years. Incredibly, in 2025 the largest 0.1% of deals (10 deals) accounted for a whopping 33% of the capital deployed throughout the entire year. That level of top level concentration has not been seen before. Additionally, a large amount of this capital came from traditionally non-venture capital sources, such as sovereign wealth funds and other forms of state strategic capital. But still, this illustrates both how concentrated this space has become (a different application of the power law, perhaps) and how many of the available dollars the AI craze is vacuuming up.

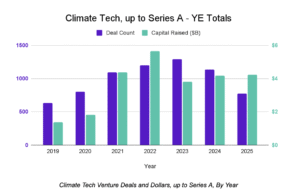

Taking a closer look at Evergreen’s neighborhood of the venture capital sector, where we see firsthand what’s happening at the earlier stages, the deal count contraction was a lot more pronounced.

Looking at deals through Series A, deal count is 40% lower than the previous annual peak, and suffered a 32% contraction in just the past year. Capital deployed was flat, which suggests the median deal size has increased in the past few years.

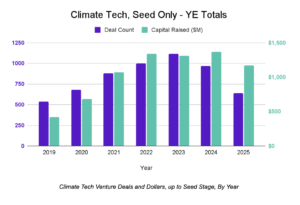

Worryingly, the Seed stage continues to see the largest contraction. The annual 2025 deal count figure is lower than 2020, so you might even consider this a trough for the “cleantech 2.0” cycle. And since the Seed stage deals of today lead to the Series A (and beyond) deals of tomorrow, it’ll be interesting to see how the sector overall adapts to a landscape with potentially less investment opportunities.

Despite all of this, perhaps the most exciting news in the sector came not in 2025, but in the early days of 2026. A few large names in the clean tech space, Fervo and General Fusion, are reportedly going public this year. Nothing can buoy investor appetite quite like successful exits. It’ll serve as a critical point of validation for not only public investor appetite to support such innovations and business models, but also return funds back to LPs who can then keep the cycle of VC dollars moving forward. Likely more than anything else mentioned in this post, these upcoming results can provide a double (triple?) shot of espresso that the climate tech venture capital sector can use in 2026.

***As always, all data referenced here is queried from Pitchbook. Please let us know if there is any additional analysis you would like to see in future posts on this subject. ***