McBatteries

China’s Batteries Are Now Cheap Enough to Power Huge Shifts”, Colin McKerracher, Bloomberg, July 9, 2024 – Borrowed from Andy Lubershane’s Steel For Fuel August 7 Blog Post

China’s Batteries Are Now Cheap Enough to Power Huge Shifts”, Colin McKerracher, Bloomberg, July 9, 2024 – Borrowed from Andy Lubershane’s Steel For Fuel August 7 Blog Post

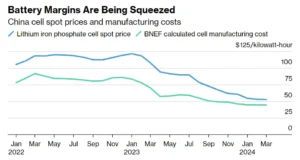

Energy Impact Partners’ Andy Lubershane highlighted research from Bloomberg on Chinese battery manufacturing and just how dramatically these have changed prices (and squeezed margins in the process), with prices declining by perhaps 50% just over the course of 2023. This rockets LFP batteries far ahead of where most folks thought they would be just a few years ago, and is well under the roughly $100/kwh threshold where EVs become cost competitive with internal combustion engines. What is less clear is how much of this is because of Chinese industrial policy and how much is actual reductions in the cost of production, although people smarter than me think it’s mostly the latter. As Lubershane points out in his blog post, this puts tremendous pressure on any potential competitors for shorter duration storage.

LFP batteries are becoming the McDonald’s of energy storage: a cheap and effective way of filling up, and you know what you’re going to get, even though it’s not the best thing out there.

Inflation Reduction Act Reductions?

Credit: CNN

Credit: CNN

With election season in full swing, there is a lot of hand wringing and prognosticating about what the election would mean for climate policy, namely for the Inflation Reduction Act.

While there is some uncertainty about what could happen to some provisions in the bill, should Republicans win the White House, take back the Senate, and retain the House, even in that scenario a full repeal would be extremely unlikely. Recently, a handful of Republicans publicly signaled they would not support repealing the IRA. So, barring the unforeseen, even with Republican gains across the board, a lot would stay – because the law is providing support to corporations who are creating jobs in these Representatives districts. Indeed, the House Speaker recently confirmed that they would not look to do a wholesale repeal. Of course, if Kamala Harris wins the election, and/or Democrats take a majority in either chamber, cuts to the IRA would be somewhere between unlikely and off the table as well.

Nonetheless, for companies planning major capital expenditures, the political positioning does create some uncertainty, so I imagine once there is more certainty on the longevity of the IRA after the election we are likely to see numerous additional investment announcements (assuming there is positive clarity about it sticking around).

Improving Carbon Credit Quality

Credit: carbonremovalstandards.org

Credit: carbonremovalstandards.org

A new effort, the Carbon Removal Standards Initiative, recently launched to help nonprofits and governments develop standards with rigorous quantification for carbon removal, led my someone who is a known quantity in the space and with financial support from important climate tech players Breakthrough Energy and Grantham Foundation.

This is good and useful and important, both to craft effective standards and policy, and also to help provide confidence that these approaches can actually be counted on to mitigate climate change and are not seen as greenwashing in any way. And these standards are specifically for carbon removal (also known as engineered carbon removal), the nascent but high potential advanced approaches to reduce carbon dioxide in the atmosphere via approaches such as direct air capture and enhanced rock weathering.

On a separate but related note, the Integrity Council for the Voluntary Carbon Market recently announced that its stamp of approval couldn’t be used on carbon credits related to renewable energy (which is a third of the voluntary market today). In this case, they are getting the ax because its hard to show that the projects wouldn’t have been built anyways (ie without the credits being sold). In contrast, carbon removal projects are typically built specifically for removing carbon dioxide (although they may have other co-benefits or revenue streams), so it’s easier to analyze their additionality.

These are both moves intended to clarify what’s good and counts, and what doesn’t and how to ensure it. That’s a good thing! Although it might impact the voluntary carbon market in the short term, this helps provides additional clarity and rigor and is good writ large (the same way that regulators penalizing unscrupulous businesses is good for an industry as a whole because it can increase confidence in the other players). As we mentioned back in May, there needs to be more requirements to clear out the low end of the market (in terms of quality) – this is a step in that direction, although more will need to be done.

Breakthrough Energy!

TechCrunch highlighted the work of our good friends Breakthrough Energy and Azolla Ventures, engaging startup founders early, sometimes before companies have even been founded.

On topic: the Breakthrough Energy Fellows applications just opened (deadline: December 2).

The program is focused on technologies that have the potential, at scale, to reduce or capture greenhouse gases by at least 500 million tons per year or technologies that address adaptation to climate change.

Also, Breakthrough Energy Ventures just raised $839 million for a new fund to invest in companies like the ones that are being cultivated by the Breakthrough Energy Fellows program.

Other News

Credit: AES Corporation

Credit: AES Corporation

The New York Times highlighted new robots developed to install solar panels more efficiently and cheaply.

Evergreen co-hosted an event during the DNC Convention in Chicago; the Political Climate podcast recorded portions of this episode at the event.

The Biden administration announced $2.2B in federal funding for a number of transmission projects that will help enable more renewables to flow to load centers – this includes the North Plains Connector project, which will add an intertie between the eastern and western grids in Montana. Currently there is very limited capacity to move energy between these grid systems, which unfortunately have a seam that runs along some of the most productive real estate for wind and solar, which means these places are at the edge of their respective grids (even though they are in the center of the country).

Last month I mentioned the extended range EVs (EREVs) being built with backup gas engines in China; Hyundai recently announced they would bring one of these EREVs to market in 2026.