Disclaimer: The information presented in this blog post is for informational purposes only and should not be considered as financial advice.

At the beginning of 2023, Evergreen Climate Innovations hosted the 2nd annual Climate Tech Investors Predict game show. We brought on a set of climate tech investors representing a wide spectrum of venture capital firms to predict what would happen in 2023 in a variety of areas such as cleantech startups, commodity trends and public stocks. In this post, we’ll review where our investors did well, and not so well, and ultimately reveal the winner.

However, we can’t credibly comment on these predictions without also acknowledging the global macroeconomic environment that characterized 2023. This past year will go down in the history books as a year that never stuck to the script. It is also a valuable lesson in understanding that though we might have more data at our disposal than ever before, that does not necessarily translate into a more accurate reading of the future.

2023: The Recession that never was

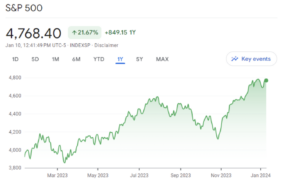

The beginning of 2023 seems so long ago. Marked by challenging factors like rising interest rates, persistently high inflation, and escalating energy costs, you might have gone into the year with some apprehension. And that was before an unforeseen banking crisis shocked the system a few months later! While popular opinion expected a recession to tamp down inflation, macroeconomic data over the course of the year turned out to be pretty favorable. Not only did the stock market deliver robust performance, but the United States managed to navigate through the storm, reducing inflation without experiencing a significant surge in unemployment or other undesirable economic indicators.

The S&P 500 posted a significant increase in 2023 to erase nearly all of the losses experienced in 2022. (Credit: S&P)

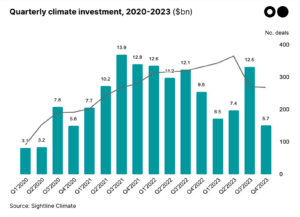

While the broader economic landscape painted a relatively optimistic picture, the same cannot be said for venture capitalists in the cleantech sector. Persistently high interest rates allowed investors across capital markets to be more picky when it comes to where they park their money. The allure of earning a risk-free 5% from the US Treasury set a higher threshold for convincing investors that any other investments, be it private equity, commercial real estate, or climate tech ventures are a bet worth taking. Data from CTVC underscores the impact, illustrating a notable drop in investment activity in the clean tech sector in 2023, particularly when compared to previous years.

Despite these challenges, the tide started to turn in the last two months of 2023. The shift in expectations regarding the future Federal Funds rate, evident in the significant drop in the 10-year interest rate yield during the last two months of the year, suggests a positive turn of events.

Yield on the 10-year Treasury throughout 2023. (Credit: Trading Economics)

For founders and startups in this challenging landscape, this shift signals a friendlier fundraising environment may be on the horizon. The potential decline in interest rates could result in an influx of capital, prompting investors to reconsider their cautious stance and deploy more funding off the sidelines.

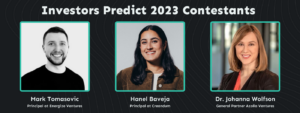

2023 Investors Predict: The results are in

Amidst these macro trends entering 2023, a set of climate investors took a stab at projecting what the climate tech venture landscape might look like through the rest of the year. The Investors Predict 2023 was a game show for all things related to climate tech trends. Contestants Mark Tomasovic of Energize Capital, Hanel Baveja of Creandum, and Dr. Johanna Wolfson from Azolla Ventures battled it out in order to be crowned the winner, and in the end we had a nail biting finish.

Unsurprisingly, no one’s crystal ball is perfect. While there were a few areas that caught our investors off guard (looking at you, price of lithium!), they fared pretty well in their prognostications of how 2023 would shape up in the world of climate tech.

A copper crystal ball

Our investors demonstrated impressive precision in predicting the price of copper, with top guesses closely aligning with the actual 2023 year-end figure of $8,475 per ton. Because of its massive market and ubiquity as an industrial input, this critical mineral has earned the nickname “Dr. Copper”, having proven to be a (somewhat) useful indicator of the health of the global economy. Its 5% price decrease in 2023 may have more to do with somewhat slower-than-anticipated global economic growth and less a sign of slowing demand for the energy transition, but little can be certain given this commodity’s ubiquity in today’s economy. Nonetheless, our investors’ crystal balls performed admirably well here with estimates of $8,000 and $8,400 (a mere $75 off the final price!) provided in the competition.

Deflating natural gas

2022 was a real roller coaster for natural gas, with a near tripling of the price in the wake of Russia’s invasion of Ukraine. Then as nations raced to secure new LNG supplies alongside a surprisingly warm winter, natural gas prices started to decline towards the end of the year. 2023 was much milder in its price range, though natural gas did still show some large gyrations and eventually decreased in price by over 20% to a year-end figure of $2.58 per mmBTU. This proved a challenging commodity for our contestants to accurately forecast, as they all guessed a much higher price of Henry Hub natural gas than what reality had in store, with the closest investor still overestimating the final 2023 price by 35% at $3.50.

A mostly calm year in price swing for Natural Gas. (Credit: ycharts.com)

Lithium loses its charge

Lithium, in particular, emerged as a wildcard in the predictions. Heading into 2023, lithium’s price had seen a tremendous rally from the beginning of 2021, with its price increasing a whopping 10x! However, due to a variety of factors (such as high interest rates making financing an EV less attractive, fewer EV sales than expected to name a few) the price of lithium crashed by a staggering 80% to $13,500 per ton of lithium carbonate throughout 2023. Our contestants were much more bullish on the price of lithium, with the most conservative estimate exceeding the actual price at a whopping $80,000 per ton.

Lithium prices came crashing back down to Earth in 2023. (Credit: Trading Economics)

Stock up on this pick!

We also asked our brave contestants to select a public stock related to climate tech, and tracked their respective performances over the year. While 2023 was broadly a good year in the markets, the same could not be said for the cleantech sector. One market-wide ticker that is useful for measuring this sector is ICLN, the iShares Global Clean Energy ETF. ICLN had a pretty terrible year, trailing the S&P 500 by a massive 45%. That makes it even more impressive that one of our contestants, Mark Tomasovic, had an exceptional public equity pick of Quanta Services (NYSE: PWR). This stock outperformed expectations and achieved a 40% stock appreciation, surpassing the S&P by an impressive 22% in 2023. Kudos, Mark! We’ll be sure to follow you on social media to find the next place to park our kids’ college funds.

And the winner is…

Those are just a few of the predictions made by our contestants. You can watch the full episode here. And now, the moment we’ve all been waiting for – the big reveal of our winner! Drumroll please… Hanel Baveja emerged victorious, showcasing astute predictions on climate tech venture capital deployment and correctly identifying “Industry” as the investment theme poised for the most VC funding growth across all climate tech sectors.

Predicting 2024

As we embark on the journey into 2024, we’re shaking things up. Rather than featuring a select panel of investors, we want to hear from you – our valued community. Stay tuned for exciting opportunities to share your opinions and prognostications in the dynamic world of climate tech!