It’s time to summarize the results from our inaugural Co_Predict survey! Thank you for all who responded. We are excited to run some tallies at the end of the year and see how accurate our collective community was in prognosticating the future. But for now, we wanted share some highlights of the predictions we found the most interesting.

To review, this survey consisted of 10 questions covering topics across what the future of climate tech will look like in 2024. Everything from how much would be invested into the space to the price of commodities and the performance of public markets. As an added layer (and out of friendly competition), we had participants self-identify into investor and non-investor groups. We’re curious to see who will come out on “top!”

Climate Tech VC Bounces Back!… But Only a Small Bounce

Our community consensus determined that Climate Tech VC would only see a modest 10% bump in 2024 compared to 2023’s figure, resulting in a total of $35bn invested into the sector this year. Both investors and non-investors were pretty well aligned on this figure. While it’s way too early to make any predictions based on the first few weeks of the year, interest rates may be staying higher for longer, extending restrictive fiscal conditions that may result in a slowdown of capital deployment. The year still has a ways to go, and we’ll certainly be keen to follow how both the early and later stages of Climate Tech VC progress throughout the year.

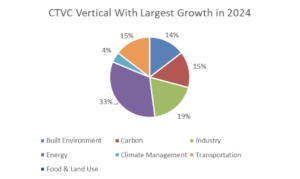

Much Love for Energy… But Not Food

Amongst the different verticals, our community were the most bullish on the Energy sector to see the largest growth in 2024. Industry finished 2nd, with Food & Land Use and Climate Management proving the least popular verticals.

Investors Are Ready for a Uranium Pullback

One of the largest divergences we saw in our survey results was in the ending price of Uranium. Investors largely expected this hot (in more way than one!) commodity to come down 20% from its current elevated level to $82. Non-investors meanwhile think the price will remain largely elevated near the $100 mark through the end of the year. $80 would still denote a 15-year high for Uranium, but it’ll be interesting to see if this commodity has more room to grow as supply constraints continue while the world is working towards decarbonization in the power generation sector.

EV Sales Will Continue Their March Forward

Much has been said about the slowdown in EV Sales in 2023. The situation wasn’t so much a slowdown in EV sales so much as it was easing off the accelerator. Our community believes on average that EV sales will continue their ~2.5% annual growth rate of light duty sales and end the year at 11.5% of new vehicle sales. This result would continue the linear growth rate seen in previous years.

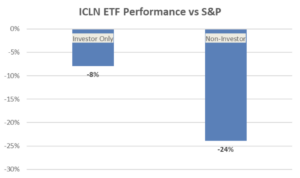

Investors and Others Are Bearish On Clean Tech In the Public Markets

The ICLN ETF had a rough 2023… and our community surmises that will continue in 2024. While Investors predict this will lag the S&P Index by 8%, non-investors see the clean energy-focused ETF lagging the broader market by 24%.This would still be a large improvement from the bad year the ICLN ETF had in 2023, but would not be a reversal that many investors would hope to see. As of the time of this writing, the S&P Index has already advanced 8% this year while ICLN has retracted a further 10%. Who knows where this will end up at the end of the year, but at this point it appears that the non-investors may be beating investors at their own game.

Show Us Your Public Stock Picks

As was expected, our ask to provide a cleantech public sector stock pick came back with a very diverse set of answers, full of companies that operate in all different sectors. One notable finding was the lack of public EV companies picked. Seen as a general bellwether for cleantech’s momentum and indicator of public embrace, this could seem like a bold prediction. However, given the year-to-date performance thus far of the younger entrants in this market, such as Rivian (RIVN, -11%) and Lucid (LCID, -23%), our community has shown its investing prowess in the first couple of months of 2024.

What’s Next

Predictions, as we all know, are educated guesses – a blend of insight and speculation. While no one has a crystal ball, taken in aggregate, our collective knowledge may end up being more right than wrong across these slew of topics. It’s been great to hear the hypotheses from our incredible climate tech community and we look forward to checking back in as the year progresses to see how everyone fairs!