OBBB

Last week, a bunch of old people got dressed up and stayed up all night arguing whether or not to wreck the solar industry and take healthcare away from poor people via the One Big Beautiful Bill act. It passed the Senate, and then after some arm twisting, passed the House a couple days later. Between getting introduced, amended, and voted on, it got way worse for energy (with a new tax specifically for wind and solar that would have had major economic impacts), then a little less bad – the new tax was stripped out, and an R&D tax deduction was restored.

The legislation is positive or neutral for sustainable aviation fuel, geothermal, and nuclear, and worse for everything else. Consumer tax credits and energy efficiency in particular were eliminated, and, whereas the Inflation Reduction Act moved from a technology specific tax credit approach to a technology neutral approach, this legislation moved back to be technology specific.

I think this approach to cutting incentives for low carbon solutions while also growthing the deficit is penny wise and pound foolish. One plot line to watch over the next couple of years is how making it harder to finance and build renewable energy projects impacts our overall energy portfolio during a period of load growth. Over the last couple of years, practically all of the new generation coming on the grid has been wind and solar (along with battery storage), and is what is primarily in interconnection queues currently.

That said, this bill also just reflects different starting points for what is trying to be accomplished. The Inflation Reduction Act used tax policy as a stand in for climate policy, similar to how the tax code is used to influence many sectors in the American economy (partially because people like carrots more than sticks, partially because it is easier to pass tax policy than traditional policy). If you had to boil it down to an objective summary, the OBBB uses tax credits for innovation policy, but not climate or energy policy more broadly. Put another way, the OBBB mainly focused its cuts on solutions that are important to decarbonizing our economy, but are available in the market today (like solar panels, electric vehicles, and more efficiency windows); it reserved tax credits for areas where more innovation and development is required for scale up (like geothermal energy, advanced nuclear, and sustainable aviation fuels.). There are exceptions to this, but I think that’s a useful heuristic.

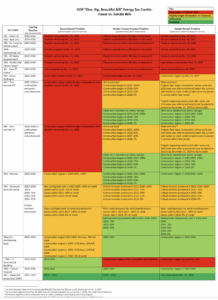

Here’s a summary of the legislation from Clean Energy Business Network along with this helpful color coded chart:

Clinton Generating Station (Credit: Constellation)

Clinton Generating Station (Credit: Constellation)

Nuclear Power is so Meta

Meta agreed to purchase power from the nuclear power plant in Clinton, Illinois to ensure it would maintain long term operations. We have heard a bunch this year of tech/data companies being interested in nuclear power; one unique thing here is the mechanism.

Back in 2017, Illinois offered a subsidy program for existing nuclear power plants to make sure they didn’t close prematurely, but it wasn’t a flat payment to the owner, it was a credit system that only kicked in when it needed to (ie when the revenues of the plant decreased beyond a certain threshold. This Meta deal essentially takes over this subsidy regime. This is notable since It is not that often that you see a government subsidy turn into a private business agreement (I am having trouble thinking of another example like this – maybe something related to space flight). Also, Clinton is one of the last remaining single reactor sites – which means it is likely one of the more expensive plants to operate, so it underscores the lengths tech companies are going to to secure low carbon power. On the other hand, the Illinois state subsidy regime may have served a useful price-setting function to make it easy to say what the delta / premium needed to be to make the deal happen.

In other data hungry power news, Meta also made a couple of geothermal energy deals recently, and Nvidia invested $650 million into nuclear company Terra Power through its investment arm.

Durable EV Batteries

Recent research from Geotab suggests that electric vehicle batteries last a really long time. It wasn’t that long ago that one sticking point with EVs was the likely need to replace the battery at some point; in this analysis, most batteries can last 20 years or more (significantly longer than the US average passenger vehicle lifespan of 14 years), with the typical batteries only degrading 1.8% a year.

This finding has a bunch of downstream implications – it suggests the overall emissions profile of EVs may actually be lower than previously expected, might lead to fewer batteries being repurposed into second life application (or recycled), and could put downward pressure on vehicle purchases long term (although lots of things go wrong with old cars beyond the motor/engine/power source of course).

One thing I think about is how in a decade or two, we’re going to have a whole bunch of an emerging tier of old EVs that have limited range (at least by US standards, maybe 150 miles or so), but still work fine. I envision these as the go-to vehicles for college students and people on a budget, where used cars accidentally get more affordable again because the batteries last so long.

Other News

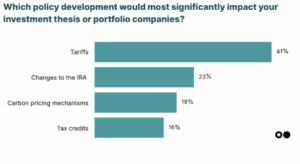

Sightline Climate and Elemental Impact collaborated to release a survey on climate tech investor sentiment. One takeaway: Tariffs, not the IRA, were the policy change that would most significantly impact investments and portfolio companies.

Credit: Sightline Climate

Credit: Sightline Climate

In the United Kingdom, energy provider Octopus Energy is collaborating with Chinese EV company BYD to offer a package that provides a leased entry-level electric vehicle, bidirectional charger, and free EV charging for about $400 a month. BYD gets another sales channel, and Octopus gets to use the vehicles as a grid asset as part of a virtual power plant.

Trump fired one of the NRC commissioners. I’m not a lawyer but sounds like this is probably illegal, definitely unprecedented, and more importantly, counterproductive! Regardless of how anyone feels about any specific commissioner, the end result will be the NRC is less able to do things (like help work towards some of the President’s goals towards expanding nuclear).

Chicago based friend of Evergreen Energize Capital announced its third venture fund, at $430 million.

The University of Chicago’s Polsky Center recently launched Harper Court Ventures, a $25 million fund to invest in affiliated deeptech startups.

Waymo has continued to make steady progress cannibalizing ride hailing market share from Lyft and Uber. It’ll be interesting to see where things stand in Austin a year from now with Tesla recently starting their autonomous rollout as well.

Heatmap reports on a new report from Clean Air Task Force that highlights some of the limitations of using Levelized Cost of Energy (LCOE) for solar power. I think this is relatively uncontroversial – LCOE tells you what’s cheapest to deploy, but is not a comprehensive metric for planning on policy that factors in capacity factor, transmission capacity, availability, grid forming capabilities, etc…

The Department of Energy is attempting to cancel a large number of demonstration project grants, including a lot in the carbon capture space. My guess is that this messes up many of the projects and leads to the death of some of them, but eventually gets reversed on the merits (these are contracted projects and a legal standard exists that doesn’t allow the government to act arbitrarily, although the closest I got to law school was taking the LSAT so this is not legal advice).

LG opened its first Lithium Iron Phosphate (LFP) battery plant in the US in Holland, Michigan. China has dominated LFP supply, which is less energy dense than nickel rich chemistries but also cheaper.

Developers have plans to add a bunch of new natural gas power plants to the grid, although most of this is projected for 2028 and beyond (my impression is that there’s a 2-3 year wait for natural gas turbines right now, so that explains the timing. This will increase grid emissions on net, although a bunch of newer plants do have the ability to do some hydrogen co-firing (so that the companies can partially future-proof their projects for when their emissions may be priced or restricted).