Grid Rulers

So just last month, we were talking about how upward prize pressure, slow generation interconnection processes at RTOs, and significant new loads being developed in the form of data center build out was going to lead to action. As I noted:

And this increased attention and salience will lead to action. It was a sleepy issue, now it’s a political issue, which doesn’t mean it will be solved optimally, but it will definitely be focused on and addressed in some way.

And lo and behold, major policy action from a political appointee, the US Secretary of Energy! Chris Wright told FERC to focus on fast tracking large load interconnection, clean up some processes and encourage large load flexibility. A bunch of stuff the DOE is doing these days is short sighted or wrong, but this seems reasonable and timely to me. This proposal would expand FERC authority to large load interconnection (a stronger federal hand would help here I think, as it would on the transmission development side).

On the load flexibility front, the idea is to have heavy grid users (like data centers) shed load in peak periods, which OpenAI endorsed. That said, the devil is in the details – there was a proposal PJM made a few months back that was widely rejected, partially because it was an uncertain one way ratchet (requiring load flexibility for new large loads without something commensurate in return. Presumably there needs to be specific guardrails / economic terms / agreement up front on what the terms would be here, but there’s absolutely an emerging opportunity to essentially trade flexibility for speed to market under the right conditions.

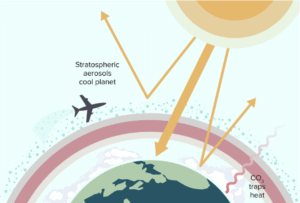

Solar Geoengineering Diagram. Credit: Harvard SCoPEx experiment

Solar Geoengineering Diagram. Credit: Harvard SCoPEx experiment

SAI What?

Geoengineering company Stardust raised a $60M venture round to develop stratospheric aerosol injection (SAI) systems to help cool the planet to counteract global warming. I am not entirely sure what the business model is here; the estimates of what it would cost to make a dent are significant but not inconceivable, maybe a billion dollars. That’s a lot for me to shell out personally, but there are some folks who might be very incentivized to have their cities not get hotter. Saudi Arabia, for example, brings in more than $100B in oil revenues a year and is a pretty warm place – I think it is conceivable that a state such as this could decide it wanted to deal with global warming this way, although the implications of a move would be very significant.

The details are light on the specifics of Stardust’s approach, but it seems like they are trying to develop less harmful particles to use. We know that if we stick some sulfur particles in the stratosphere, that will cool the planet, but that also causes sulfuric dioxide pollution that is hazardous to human health, which is one reason there is trepidation about such an approach.

Credit: Google

Credit: Google

Carbon CAPTCHA

Google made a deal to buy the power from a natural gas plant with carbon capture being developed, underscoring their need for both more power and the company’s focus on balancing power demands with their overall emissions goals. Once built, this would be the second utility scale generation project with carbon capture in the US (besides the Petra Nova coal plant in Texas) and the first natural gas plant.

What’s Causing Prices To Go Up? (Are They Going Up?)

LBNL and Brattle group released analysis on the drivers of power price are increasing that suggests it is much more complicated than “data centers” (here’s a Latitude Media post covering this research). In short, there’s a lot going on, some of it is regional, and some of the bigger influences are replacing distribution infrastructure, extreme weather mitigation, natural gas price variability, and net metering policies – not, notably, load growth associated with data centers. Also, economy-wide inflation played a big role – in nominal terms, power prices were flat on average over the last five years, and lower than they were 15 years ago.

Credit: LBNL & Brattle

Credit: LBNL & Brattle

Illinois Policy

During veto session in late October, the Illinois legislature passed a couple of big bills related to climate and energy. Veto session ostensibly exists to provide an opportunity for the legislature to meet to override vetoes the Governor has made and has a higher vote count threshold, but in practice it’s another mini session to try to finalize agreements on legislation that didn’t happen during the regular session, and because Democrats have a supermajority in both chambers, they are able to use it to legislate despite the higher requirement. But more to the point, there will bills passed to a) develop more energy storage and makes geothermal projects eligible for state incentives, in order to put downward pressure on future electricity prices, and b) a transit reform bill to improve transit governance and better fund these collective systems in light of looming fiscal challenges brought on by changing patterns from the pandemic. A busy season for climate and energy advocates!

Electric Vehicles After Tax Credits

The elimination of electric vehicle tax credits via the OBBBA is having major impacts on the auto industry. However, not all of them are exactly what you’d expect. While overall there have been a number of cancellations and changes to timelines from automakers, this happened right as a number of automakers were really figuring out how to make these vehicles more efficiently, and importantly, after they have already committed to the strategy globally. As a result, some new models like the Hyundai Ioniq 5 just received a significant price cut to make up for the fact that there is no longer a tax credit (so a buyer today is no worse off than a buyer 6 months ago. This will undoubtedly cut into profit margins in the near term and overall, we should still expect EV sales to slump for the time being. That sai, these automakers are moving rapidly in this direction globally regardless of policy changes in the US.

Other News

Rare earth restrictions from China were lifted for a year after a trade war truce between the US and China

The Energy Policy Institute at the University of Chicago (EPIC) launched an Emissions Market Accelerator Program to help emerging economies develop and implement emissions markets like cap and trade systems.

This Resources For the Future report suggests that intra-day arbitrage won’t be sufficient to finance LDES systems and that long term capacity market type constructs will be required to scale the technology.

The Trump administration is putting pressure on the International Maritime Organization to delay a vote to implement global legally binding rules that would force the shipping industry to reduce its carbon intensity via what is essentially a global carbon tax for large international shipping vessels – a potentially big deal since this body’s ruling is seen as the driving force for new alternative fuel technologies for maritime.

Amazon announced it was tripling its SMR project size with X Energy to almost a gigawatt, built in multiple phases, with each reactor producing about 80 megawatts of power.