Credit: Jim West/Alamy, from the New York Times

Credit: Jim West/Alamy, from the New York Times

Nuclear Awakening?

This month there were announcements that not one but two nuclear power plants that had previously been shuttered were going to be re-opened. The DOE announced a package of financing that will enable the Palisades nuclear plant in Michigan to come back online; meanwhile, Microsoft agreed to buy the electricity from Three Mile Island in Pennsylvania to power its data centers. With an explosion in data centers driving new load growth for the first time in decades, we need all the low carbon power we can get. These moves are a good thing – they were shut down not because there was something wrong with them, but because we have had an incomplete market that didn’t prioritize low carbon resources.

That said, just reopening a few shuttered plants isn’t going to be enough of course. One area where there is something wrong is the underlying regulation and permitting of new nuclear, which is still a primary driver of cost and hampering our ability to bring on a newer generation of nuclear power plants online. Nuclear power is a small area of bipartisan agreement on energy policy (along with incentives for wind and solar), so I remain optimistic for improvements on this front in the future, although it would involve threading a needle between some environmentalists who are against nuclear power and the existing concrete layer of regulation.

Credit: Holocene

Credit: Holocene

Google DAC

Google recently announced it purchased 100,000 tons of carbon removal via direct air capture (DAC) from Tennessee-based Holocene.

DAC removal for $100 a ton*, the lowest price yet for DAC. The asterisk is that this is inclusive of a significant federal subsidy, of $180 a ton for carbon capture and permanent storage. So, still a long way to go in terms of getting to the target price of $100 a ton (which is a price that can be seen as a proxy for where carbon taxes/prices will be in the not too distant future; some western european countries already have carbon taxes higher than that). One challenge for DAC is that it is very energy intensive; Google found Holocene’s approach partially because it can use lower temperature heat rather than electricity to reset its system once it has captured CO2 (regeneration is the term of art). We were particularly happy to see this news since Holocene is a company supported by one of Evergreen’s partner and friend, the Spark Innovation Center at the University of Tennessee-Knoxville.

This remains a very nascent and challenging space, but I think it is positive that private actors like Google (as well as Frontier Climate members) are wading in to help try to drive down costs.

New NanoGraf Manufacturing Facility!

Evergreen portfolio company NanoGraf announced it had received $60 million in federal funding to support the retrofit of a manufacturing facility in Flint, Michigan. The facility will manufacture silicon anodes for longer duration batteries and eventually produce enough material to supply 1.5 million electric vehicles a year, strengthening the US supply chain for these components in the process.

FOAK = Finally One Additional Kaleidoscope?

Climate tech ecosystem support entities Deep Science Ventures, RMI, and Third Derivative are collaborating to launch Mark1, which is intended to be a service to provide support for the development of First of a Kind (FOAK) climate tech projects. There is collective agreement in the space that developing FOAK projects remains a major challenge (Evergreen’s Co_Invest keynote speaker Rob Day spoke extensively on this subject in his remarks at last month’s event; there was even a FOAK-specific event at New York Climate week), so it is nice to see new innovative approaches in this space.

Other News

The commerce department announced new solar tariffs on southeast asia solar cell manufacturers – these are manufacturers connected to Chinese manufacturers who are also covered by anti-dumping tariffs, but who until now had not been subject to the tariffs. There is a clean energy industry fault line through this debate, with renewable project developers against these tariffs, and domestic solar manufacturers like First Solar supporting them.

This Wall Street Journal story highlights some of the challenges climate policies are facing, including increased energy demand, pushback from some industrial stakeholders, and inflation putting pressure on renewable energy project costs.

Because of a wrinkle in how the Inflation Reduction Act provisions we interpreted, there are currently a bunch of great deals on leasing electric vehicles.

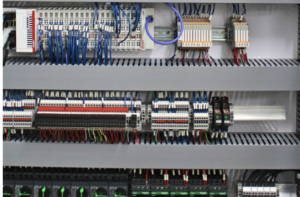

An advisory council on infrastructure recommended that the US establish a virtual reserve of electric transformers that would help incentivize supply chain investments in this sector. Although the lead times for this equipment have stabilized after increasing in recent years, they are still robust – 2 years is typical, and up to 4 years (!) for bigger equipment – boring perhaps, but one of the major pinch points for new projects.

Latitude Media highlighted a DOE report focused on the potential for virtual power plants and better integration between distributed assets and the grid (and the technologies and rules and regulations related to this integration) as a key innovation challenge for solar.