Power Generation Market?

The Trump Administration, joined by a broadly bipartisan group of governors, announced plans to essentially override the PJM market by having a backstop procurement conducted specifically for tech companies to pay for new generation, with a plan to award 15 year guaranteed revenue agreements to new generators. Estimates suggested that this potentially procure most of the delta between what PJM was targeting to procure for reliability and what the auction was short on.

This is a sort of wild outcome – the entity (PJM) who is in charge of running the marketplace for new generation hasn’t been able to agree on rules and market structures that actually led to the market to function, and now people who don’t agree on anything else (like Pennsylvania Governor Josh Shapiro and President Trump) are coordinating to influence and/or conduct an end run around this market failure. PJM is proposing a backstop auction with some overlapping ideas as this bipartisan/DOE proposal as well, and analysts have suggested that the Administration’s move lacks binding authority, so is more about policy signaling. The political salience is high, so the proposals are flying! As I noted in September:

And this increased attention and salience will lead to action. It was a sleepy issue, now it’s a political issue, which doesn’t mean it will be solved optimally, but it will definitely be focused on and addressed in some way.

So, it certainly seems like there will be some sort of backstop auction at some point in the next year to procure more generation for data center load growth, but this of course leaves us with more questions than answers. Will this intervention actually work and will the new demanders of power actually agree to pay for long term power commitments? What happens after this one time thing? What about the interconnection process, which is still a mess? What about the energy storage that is waiting to get onto the system? Is it a solution or a band aid? As people who aren’t sure what’s going to happen like to say, time will tell!

The arson attack site at the power plant. Credit: AFP via Getty Images

The arson attack site at the power plant. Credit: AFP via Getty Images

Power Boom

Some extremists in Germany attacked a power plant and caused a power outage in Berlin. A leftist group calling themselves Vulkangruppe attacked the Lichterfelde power plant to protest fossil fuels and capitalism (I think). As an outside observer, I found it a little strange that they attacked a combined cycle natural gas facility, which is pretty efficient and cleaner than many others, compared to say a coal plant, but presumably the goal was to create a power outage in Berlin and generate coverage for themselves).

Now is a good time to note that violence is not the answer; it also made me think about how similar this news was to a plot arc in season 5 of Slow Horses, which is a great show.

Speaking of explosions and power outages, the US conducted an operation to grab Nicolas Maduro and now has a hand in Venezuela’s oil sales (not trying to equate Vulkagruppe and the Trump administration, just my attempt at word play). I don’t have anything differentially useful to share on this topic but it seems weird not to mention that it happened; I thought this Heatmap article was informative from an energy economy perspective.

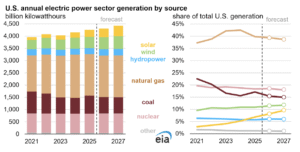

Solar Growth, Peak Load Growth

Even as the Trump administration is going out of its way to slow down or stop solar and wind projects, solar power is still driving generation growth over the next couple of years. Power projects take years to develop, so unsurprisingly the pipeline of projects being interconnected are those that have had the best economics over the recent past (which is wind and solar mostly). I have a vague intuition that the administration will back off a bit on trying to kill renewables once it sinks in how difficult it is to remake power generation development business overnight while we find ourselves needing more power, but I have been wrong many times before!

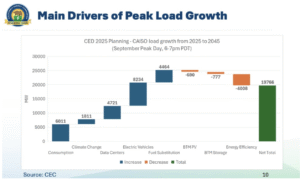

Speaking of growing loads, I thought it was interesting that in California, the Energy Commission expects more peak load growth over the next couple decades from EVs than from data centers (note, this is peak load, not total load, so part of that may just be that they assume data centers incorporate a bit more on site generation or flexibility over time so are not as significant contributors to peak demand – they are still the second biggest added to peak load by this analysis)

Lithium Ion vs LDES

Latitude Media highlighted how lithium ion is still the incumbent technology for eight hour storage (which is much longer than the typical storage project duration today, and longer than many people thought could be economic). Per the article:

One key barrier for LDES, he said, is that often a project is “too expensive relative to what it can get on the market, so it doesn’t get built.” In other words, the electricity markets still aren’t ready for LDES.

We highlighted the challenge from lithium ion as well as the lack of market readiness for LDES in our research post on the subject last summer. In addition to the market structure issues, lithium ion has many softer but important hallmarks of incumbents as well, like manufacturing scale, clear understanding of how repairs, replacements, financing, and warranties will work, supply chain redundancy, and general market knowledge and acceptance (since an 8 hour lithium ion battery is essentially a larger version of a 4 hour lithium ion battery, whereas an 8 hour zinc or flow battery is a new technology solution – one that may have many positive attributes, but it’s still a new thing vs a thing a company has dealt with before.

Credit: Randi Baird for The New York Times

Credit: Randi Baird for The New York Times

Blowing in the Wind

Offshore wind developments continue to win in court against the Trump administration’s blanket cancellations (although nothing has reached the Supreme Court yet, who will have the final say). True story, I typed this blurb out on a Tuesday and the same day I saw another offshore wind victory in court, this time for Vineyard Wind. The same thing has happened in all of these cases essentially, which is that the Trump administration ordered the companies to stop working on these projects for dubious national security related reasons, and the wind developments appealed and won injunctions to be able to continue construction while the legal case is worked out, because if they didn’t they would have half equipment with tarps over it getting blasted by winter and could lose their reservations on the specialty ships used to erect offshore wind turbines. In the case of Vineyard Wind, the most recent ruling, it is already producing power and only had 1 of its 62 turbines left to install when it was initially stopped.

Wholly Recycled Foods

Whole Foods announced they are partnering with Mill to deploy the company’s food recyclers at their stores. I thought Mill was totally weird as a residential D2C play (its main focus), but for a commercial scale it is not necessarily. It costs $1,000, used a surprisingly large amount of energy to run its cycle, and at least initially they were trying to charge customers to take their dirt, plus who has space for another trash can (maybe the kitchens of folks who purchase $1,000 luxury composting trash cans).

Having on site food recycling / dehydrating equipment at a larger commercial scale where there is a lot of food loss does seem like it makes more sense as a value prop to me, although I think half of Mill’s pitch was that it was sleek and quiet and hip, which aren’t the sorts of factors you are likely to be selecting for when acquiring industrial machinery for a loading dock I don’t think. Time will tell!

Other News and Notes

The Volta Foundation is out with their huge, detailed, and useful annual battery report for 2025. Some of the topline highlights include EV sales growth of 22% globally, including just more than half of new car sales in China (including all electrified vehicles) – here’s their linkedin post if you just want the highlights

Amazon is on an acquisition spree, buying a bankrupt solar and storage project (where they were struggling to get power capacity) and America’s first new copper resource is more than a decade for use in new data centers.

Toyota’s RAV4, the best selling SUV in America, is going hybrid-only for the 2026 model year (traditional hybrid or PHEV flavors available) – this was announced last year but I just noticed it.

Honda and GM wound down their collaboration to build fuel cells for passenger vehicles. I mention this only because I noted a couple years ago that I thought this was a dumb idea to begin with (“I’m not sure why anyone would buy a hydrogen field CR-V when they could grab a Tesla Model Y (or a hybrid CR-V for that matter), but no one pays me to be an auto analyst.), so am putting some points on the board now.

A free trade deal between the European Union and India leaves intact its carbon border adjustment mechanism (which helps protect manufacturers who are using lower carbon intensity processes from).

The Trump administration is making plans to pull the US out of the UN Climate Framework (and pulled the US out of the Paris agreement, again).

The nonprofit Reflective launched a database to help inform research related to Stratospheric Aerosol Injection (SAI), a prominent geoengineering technique we mentioned a few months back. This is a mark of a very early but active space, where folks are trying to consolidate knowledge and understand who knows what and what still needs to be figured out, much like how Frontier Climate published a database of research and innovation gaps in the carbon removal space a few years ago.